January Market Update: Fed vs Inflation

Ryan Burton • January 9, 2025

With so much happening courtesy of the Fed's change in tone, it is the perfect time to update you on the final month of 2024 as we begin the new year...

Major U.S. equity indexes closed out the final month of 2024 in a mixed fashion, with megacap tech being the bright spot and industrials heading lower.

No Santa Claus Rally in December

Santa Claus did not show up in rally mode at the end of December. We saw some quarter-end and year-end book squaring on the last couple of trading days of the month. Technically speaking, Santa had the first two trading sessions of the New Year as part of the Santa Claus Rally phenomenon, so Santa was a mixed bag during the holiday season this time around.

Chatter and growth surrounding continued advancement in AI and now quantum computing dominate many growth-oriented conversations.

For December, the S&P 500 decreased by 2.50%, the Nasdaq 100 reached an all-time monthly closing high, settling higher by 0.39%, and the Dow Jones Industrial Average fell by 5.27%.

The Dow experienced a historic 10-day losing streak, the longest since 1978. Will investors buy such a dip heading into the new year?

Stocks: Strong Year, Weak Month

It has been a wonderful two-year stretch in major U.S. stock indexes. In fact, the S&P 500 just delivered the best two-year stretch since 1998. The key is staying invested!

Through all the headlines, the interest rate cycling, elections, etc., long-term investors came out on top again.

It seems that some tariff concerns, interest rate uncertainty, jobs uncertainty, and a Fed seemingly slowing its rate cut campaign caught up to market sentiment a bit — and that only makes sense.

After all, markets do not go up in a straight line (last two years aside!). Pullbacks are often viewed as healthy in bull markets. Will we get a meaningful one anytime soon?

It is expected that AI will continue to garner attention heading into 2025, with several recent deals making headlines.

Rising Bond Yields

Generally, bonds were good to investors for much of 2024, but December changed that tune quickly with rising yields. Remember, yields have an inverse relationship with bonds.

With inflation being deemed stubborn and quite sticky on the consumer level, 10-year note yields responded in a big way in December, tacking on nearly 39.5 basis points and settling December near the 4.573% level.

So, it's bye-bye low 4s for now, with uncertainty over future economic policy and a Fed with a more hawkish stance (or at least less dovish) heading into 2025.

With 5% being the cycle high so far after the Fed hikes in 2023, some may be asking if it is a good time to buy bonds. Well, that depends on many factors, like time horizon and type of bond, amid an uncertain outlook regarding inflation and interest rates in a new presidential administration.

Here’s why one analyst says it’s not time to give up on bonds. Of course, it’s important to remember that bonds are an important part of any well-diversified portfolio, even after an era of ultra-low interest rates.

Payrolls

Market participants were looking for a perfect number leading up to December's significant jobs report, and they got what they wanted! The data was released before the December Federal Reserve meeting, however, where the Fed's tone shifted regarding the direction of future monetary policy.

The jobs data released in December was deemed as Goldilocks-like, revealing an increase of 227,000 jobs, which exceeded the Dow Jones consensus estimate of 214,000. In addition, the October jobs figure was revised upward by 36,000 following a disappointing performance the previous month.

The data was interpreted as "just right" upon the release — neither too hot nor too cold, offering encouraging news for those anticipating a December Fed rate cut.

Recent job opportunities have seen notable increases in the health care, social assistance, and leisure/hospitality sectors.

Many are optimistic about the current labor market, which indicates economic growth without the risk of overheating. This type of scenario keeps the door open for potential future rate cuts by the Fed in the near term, although it looks like fewer rate cuts in 2025 than previously thought.

The U.S. unemployment rate ticked up to 4.2% in December in line with expectations.

Inflation

Consumer Inflation Increase: Well, the final phase of tackling inflation is taking longer than many would hope to see. Consumer Price Index (CPI) data for November showed a monthly increase of 0.3%, raising the annual rate to 2.7%, up from 2.6%.

Sectors like housing and services continue to drive inflation metrics higher, though shelter prices may be stabilizing. Despite CPI and Producer Price Index (PPI) remaining above the Fed's 2% target, market reactions were optimistic, suggesting an increased likelihood of a rate cut in December, and the Fed delivered on that optimism.

Core CPI, which excludes food and energy, rose by 3.3% year-over-year and 0.3% month-over-month.

Market Reaction: Major U.S. equity indexes reacted positively to the consumer inflation data upon release, but by week's end, results were mixed, with the Fed signaling a shifting tone on interest rates for 2025.

The Dow Jones and S&P 500 declined, while the Nasdaq 100 gained on the week of the CPI data release. Sentiment has been tempered somewhat since, and PPI data warranted additional caution.

Producer Pricing Hot: After a mostly in-line CPI report raised expectations for a December rate cut, the December PPI data release revealed stronger-than-expected wholesale prices.

The monthly increase was 0.4%, exceeding the Dow Jones estimate of 0.2%, while annual wholesale prices rose by 3.0%.

This uptick in prices was driven largely by food, with significant gains in pricing.

Fed Tone Pivot & Interest Rate Expectations

The Fed cut the benchmark overnight lending rate at its December meeting by 0.25% (25 basis points), bringing the target rate to 4.25%-4.50%, meeting market expectations. The move came after a 50-basis-point cut in September and a 25-basis-point cut in November.

However, the Fed indicated that it is looking at two interest rate cuts in 2025 versus the four that it had projected at the September meeting.

This shift to a potentially less-dovish Fed created a surge in volatility across financial markets, but it was rather short-lived as of the time of writing.

Fed Versus Inflation (Still!)

As January began, the feeling across markets was that we saw some year-end short-term profit-taking and book squaring across many assets. Markets could be overdue for a pullback after this recent runup. This could create opportunities for investors with cash on the sidelines. Quantum computing and AI will continue to garner investor attention.

Since market timing is so difficult to achieve, we will continue to stick to the plan of periodic investing across diversified portfolios that has worked so well over the last couple of years.

Keeping you informed is a top priority, and as more developments occur, we will keep you apprised of them. And of course, if your New Year’s resolution is financially based or if there is anything I can help you with, don't hesitate to get in touch with one of our Advisors. We are always here as a resource!

By Ryan Burton

•

December 15, 2024

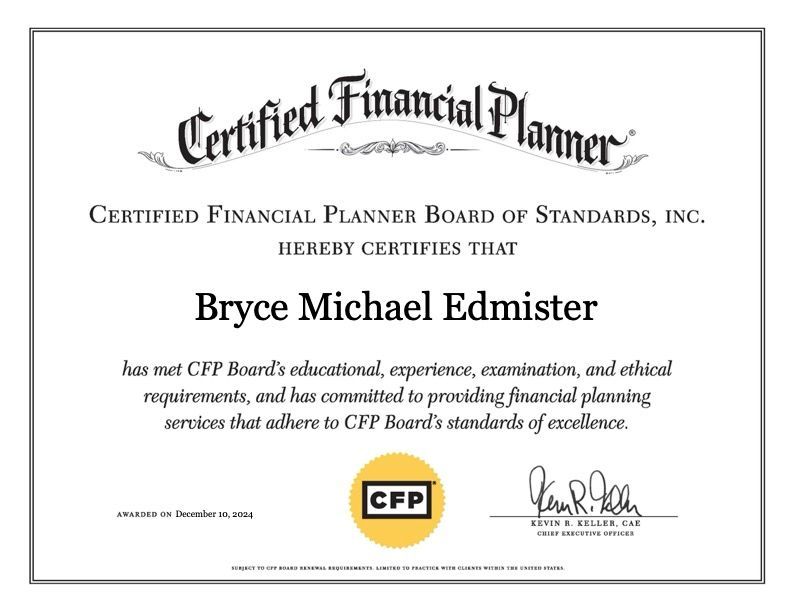

We are pleased to announce that team member Bryce Edmister has officially earned the Certified Financial Planner (CFP®) designation! This esteemed certification is a testament to his dedication, professionalism, and expertise in financial planning and wealth management. As a CFP®, Bryce is now even more equipped to provide our clients with informed and comprehensive financial strategies. Please join us in congratulating Bryce on this significant professional achievement!

September 8, 2024

What’s not to like about Social Security? It promises an income for life, automatic adjustments for cost of living, and the possibility of protecting your spouse when you are gone. Benefits can start as early as age 62, but perhaps the strongest feature of social security is that your benefit increases 8% per year every year you wait to turn it on!

By Ryan Burton

•

August 5, 2024

The term "fiduciary" is often used in the financial services industry, but what does it truly mean? Understanding fiduciary responsibility is essential for individuals seeking financial advice and guidance. Defining Fiduciary Responsibility A fiduciary is a person or entity entrusted with the responsibility to act in the best interests of another party. In the financial context, a fiduciary duty requires financial advisors and professionals to prioritize their clients' interests above their own. Key Principles of Fiduciary Duty Loyalty and Trust: Fiduciaries must demonstrate unwavering loyalty and act in the best interests of their clients. This includes avoiding conflicts of interest and ensuring that all actions and recommendations align with the client's financial goals. Transparency: Fiduciaries are required to provide full and transparent disclosure of any potential conflicts of interest, fees, and compensation arrangements. This transparency ensures that clients can make informed decisions. Prudence: Fiduciaries must exercise care, skill, and diligence when making financial recommendations. This involves thoroughly understanding the client's financial situation, objectives, and risk tolerance to provide suitable advice. Accountability: Fiduciaries are accountable for their actions and decisions. Clients have the right to hold fiduciaries responsible for any breaches of duty or failures to act in their best interests. Fiduciary vs. Suitability Standard Understanding the distinction between fiduciary and suitability standards is crucial when selecting a financial advisor: Fiduciary Standard: This standard requires advisors to act in the best interests of their clients at all times. Advisors are bound by a legal and ethical obligation to prioritize clients' needs. Suitability Standard: This standard requires advisors to recommend products or services that are suitable for the client based on their financial situation and objectives. However, it does not necessarily mandate that the recommendation be in the client's best interest. Benefits of Working with a Fiduciary Working with a fiduciary offers several advantages for individuals seeking financial guidance: Client-Centric Approach: Fiduciaries prioritize clients' interests, ensuring that recommendations align with their unique financial goals and objectives. Conflict-Free Advice: Fiduciaries are required to disclose any conflicts of interest, allowing clients to make informed decisions based on unbiased advice. Comprehensive Planning: Fiduciaries take a holistic approach to financial planning, considering all aspects of a client's financial situation to develop tailored strategies. Trust and Confidence: The fiduciary relationship fosters trust and confidence, as clients know their advisor is committed to acting in their best interests. Choosing a Fiduciary Advisor When selecting a financial advisor, it is important to ensure they adhere to fiduciary standards. Here are some steps to help you identify and choose a fiduciary advisor: Ask Questions: Inquire about the advisor's fiduciary status and whether they are bound by fiduciary duty. Request information about their fee structure, compensation, and any potential conflicts of interest. Verify Credentials: Look for advisors with certifications and designations that emphasize fiduciary responsibility, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Check Regulatory Compliance: Verify the advisor's registration with regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). These organizations uphold fiduciary standards for registered advisors. Seek Recommendations: Ask for referrals from trusted friends, family members, or colleagues who have had positive experiences with fiduciary advisors. Review Disclosures: Carefully review the advisor's disclosure documents, including Form ADV, which provides detailed information about their business practices, fees, and potential conflicts of interest. Understanding fiduciary responsibility is essential for making informed decisions about your financial future. By working with a fiduciary advisor, you can benefit from personalized, conflict-free advice that prioritizes your interests. This level of trust and accountability can provide the confidence and peace of mind needed to achieve your financial goals.

By Ryan Burton

•

July 25, 2024

The current interest rate environment has sparked comparisons to the economic conditions of the 1970s and 1980s. Understanding the similarities and differences between these periods can provide valuable insights into navigating today's financial landscape. Historical Context The 1970s and 1980s were marked by significant economic challenges, including high inflation, interest rate volatility, and economic recessions. The factors contributing to these conditions were diverse and complex. 1970s Stagflation: The 1970s witnessed a phenomenon known as stagflation, characterized by high inflation and stagnant economic growth. Factors such as oil price shocks, supply chain disruptions, and expansive fiscal policies contributed to rising prices and unemployment. 1980s Disinflation: The early 1980s were marked by efforts to combat inflation through aggressive monetary policy. The Federal Reserve, under Chairman Paul Volcker, implemented high interest rates to curb inflation, resulting in a recession but ultimately leading to disinflation and economic recovery. Similarities and Differences Inflation Dynamics 1970s: Inflation during the 1970s was driven by supply-side shocks, including oil embargoes and commodity price surges. The resulting cost-push inflation led to rising prices across various sectors. Today: The current inflationary pressures are driven by a mix of supply chain disruptions, fiscal stimulus, and pent-up consumer demand following the COVID-19 pandemic. While some factors are similar, the underlying causes differ. Monetary Policy 1980s: The Federal Reserve's approach in the 1980s was characterized by high interest rates to combat inflation. This led to a recession but ultimately restored price stability. Today: Central banks today are navigating a delicate balance between supporting economic recovery and addressing inflation. Interest rates remain relatively low compared to the 1980s, reflecting a cautious approach to monetary tightening. Economic Growth 1970s: Economic growth was hindered by stagflation, leading to high unemployment and stagnant wages. Today: While the pandemic-induced recession led to economic challenges, the recovery has been more robust, with strong labor markets and economic growth in many sectors. Lessons for Today's Environment Inflation Management Central banks today face the challenge of managing inflation without derailing economic growth. A measured approach to interest rate hikes, combined with fiscal policies to support supply chains and productivity, can help achieve this balance. Risk Management Investors should remain vigilant about potential interest rate changes and inflation risks. Diversifying portfolios and incorporating inflation-resistant assets, such as commodities and real estate, can help mitigate risk. Economic Resilience The lessons from the past emphasize the importance of economic resilience. Building a diverse economy with robust supply chains and innovation can help mitigate the impact of external shocks and ensure sustainable growth. While today's interest rate environment shares some similarities with the 1970s and 1980s, the underlying economic conditions and policy responses are distinct. By understanding historical precedents and adopting prudent risk management strategies, investors can navigate the current landscape with confidence.

By Ryan Burton

•

June 19, 2024

Election years often bring a unique set of challenges and opportunities for investors. The uncertainty surrounding political outcomes can lead to increased market volatility, which may either entice or deter investors. Understanding the historical trends and potential impacts of election cycles can help investors make informed decisions. Understanding Market Volatility Market volatility refers to the fluctuations in asset prices over a short period. During election years, this volatility is often exacerbated by the uncertainty of policy outcomes. Investors and market participants tend to react to the anticipated changes in fiscal and monetary policies, which can cause stock prices to swing. While this volatility can be intimidating, it can also present opportunities for savvy investors. Historical Trends and Patterns Historically, the stock market has shown distinct patterns during election years. Analyzing these trends can provide valuable insights: Pre-Election Year Rally: The stock market tends to perform well in the year leading up to a presidential election. This rally is often driven by investor optimism and policy stability, as incumbents seek to create a favorable economic environment to enhance re-election prospects. Election Year Volatility: As election day approaches, market volatility often increases. The uncertainty about potential changes in government policies, such as taxes, regulations, and trade agreements, can lead to short-term market fluctuations. Investors may become cautious, leading to reduced trading volumes and heightened volatility. Post-Election Market Reaction: After the election results are announced, the market's reaction can vary depending on the perceived impact of the new administration's policies. Historically, markets have reacted positively to clarity, regardless of which party wins. Investors appreciate knowing the direction of future policies, which reduces uncertainty and allows for more informed decision-making. Key Factors Influencing Markets Several factors contribute to market behavior during election years: Policy Proposals: The policy platforms of presidential candidates can significantly impact investor sentiment. Proposals related to taxes, healthcare, infrastructure spending, and trade agreements are closely monitored by the market. For example, tax cuts or increases can influence corporate earnings and consumer spending, affecting stock prices. Investor Sentiment: Sentiment is a powerful driver of market behavior. Uncertainty about election outcomes can lead to heightened investor anxiety, causing rapid price swings. Conversely, confidence in a candidate's economic policies can boost investor optimism and drive market gains. Media Coverage: Media plays a significant role in shaping public perception and investor sentiment. News coverage, debates, and campaign events can create short-term market reactions. Investors should be cautious of reacting impulsively to media-driven market movements. Global Factors: Election years often coincide with global economic events and geopolitical developments. Trade tensions, international conflicts, and economic data releases can further contribute to market volatility. Investment Strategies for Election Years Navigating the market during an election year requires a thoughtful approach. Here are some strategies to consider: Diversification: Diversifying your investment portfolio can help mitigate risk during volatile periods. By spreading investments across various asset classes, industries, and geographic regions, you can reduce the impact of any single event on your portfolio. Long-Term Focus: While election-year volatility can be unsettling, maintaining a long-term perspective is crucial. Markets tend to recover from short-term disruptions, and focusing on your long-term financial goals can help you avoid making impulsive decisions. Stay Informed: Keeping abreast of political developments, economic indicators, and market trends can help you make informed decisions. However, it's important to distinguish between short-term noise and long-term trends when evaluating investment opportunities. Professional Guidance: Consulting with a financial advisor can provide valuable insights and personalized strategies tailored to your financial situation and risk tolerance. Advisors can help you navigate the complexities of election-year markets and align your portfolio with your objectives. Election years bring a mix of challenges and opportunities for investors. While market volatility may be unsettling, it is essential to remain focused on long-term goals and not be swayed by short-term fluctuations. By understanding historical trends, staying informed, and employing sound investment strategies, investors can navigate the uncertainties of election years with confidence.

By Ryan Burton

•

May 7, 2024

Mutual funds have long been a popular investment vehicle for individual investors seeking diversification and professional management. However, for high net worth investors, mutual funds may not be the most suitable choice. Understanding the limitations and alternatives can help these investors make more informed decisions. Understanding Mutual Funds A mutual fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. The fund is managed by a professional fund manager who makes investment decisions on behalf of the investors. Limitations of Mutual Funds for High Net Worth Investors Lack of Customization: Mutual funds offer limited flexibility and customization. High net worth investors often have unique financial goals, risk tolerances, and tax considerations that require tailored investment strategies. Mutual funds typically follow a predetermined investment strategy, which may not align with individual preferences. Fees and Expenses: Mutual funds charge management fees, often expressed as an expense ratio, which can erode returns over time. For high net worth investors with significant assets, these fees can add up, impacting overall portfolio performance. Additionally, some mutual funds may have sales loads or transaction fees that further increase costs. Tax Inefficiency: Mutual funds can be tax-inefficient for high net worth investors. When fund managers buy and sell securities within the fund, capital gains are distributed to investors, potentially triggering taxable events. High net worth investors may prefer investment vehicles that offer more control over tax timing and minimization. Limited Transparency: Mutual funds provide limited transparency regarding the underlying holdings and investment decisions. High net worth investors often seek greater visibility into their investments to ensure alignment with their overall financial strategy. Performance Variability: While mutual funds offer professional management, their performance can vary significantly based on market conditions and the skill of the fund manager. High net worth investors may prefer more consistent and reliable returns through alternative investment options. Alternative Investment Options High net worth investors have access to a range of alternative investment options that can better align with their unique needs and preferences: Separately Managed Accounts (SMAs): SMAs offer personalized portfolio management tailored to individual investor goals and risk profiles. Investors have direct ownership of the underlying securities, allowing for greater customization and tax efficiency. Exchange-Traded Funds (ETFs): ETFs provide diversification and liquidity similar to mutual funds but often with lower expense ratios and greater tax efficiency. High net worth investors can build customized portfolios using a combination of ETFs to achieve specific asset allocations. Private Equity and Hedge Funds: These alternative investments offer the potential for higher returns and diversification beyond traditional asset classes. While they may require higher minimum investments and involve more risk, they can be suitable for sophisticated investors seeking unique opportunities. Direct Investment in Stocks and Bonds: High net worth investors with the expertise and resources to conduct their own research may prefer direct investment in individual stocks and bonds. This approach allows for complete control over investment decisions and tax strategies. Real Estate Investments: Real estate offers diversification and the potential for income generation and appreciation. High net worth investors can explore direct real estate ownership, real estate investment trusts (REITs), or real estate crowdfunding platforms. Tailoring Investment Strategies For high net worth investors, a customized investment strategy is essential to achieving financial objectives. Here are some considerations when developing a tailored approach: Risk Management: High net worth investors should carefully assess their risk tolerance and consider strategies to mitigate risk, such as diversification, asset allocation, and hedging. Tax Optimization: Collaborating with tax professionals can help high net worth investors develop tax-efficient strategies that minimize tax liabilities and maximize after-tax returns. Estate Planning: Incorporating estate planning considerations into investment strategies can help high net worth investors preserve wealth for future generations and achieve legacy goals. Philanthropic Goals: High net worth investors may have philanthropic aspirations that can be integrated into their investment strategies through donor-advised funds, charitable trusts, or impact investing. While mutual funds offer benefits such as diversification and professional management, they may not be the best fit for high net worth investors seeking customization, tax efficiency, and greater control over their investments. By exploring alternative investment options and developing tailored strategies, high net worth investors can align their portfolios with their unique goals and preferences, maximizing their potential for success.

General Contact Info

- Mon - Fri

- -

- Sat - Sun

- Appointment Only

| Phone: | 910-742-0509 |

| Fax: | 910-210-0166 |

| Toll Free: | 800-880-5898 |

| Email: | info@masonboroadvisors.com |

Wilmington

5815 Oleander Drive (Ste 260)

Wilmington, NC 28403

910-742-0509

SANTA MONICA

2450 Colorado Ave (1st Floor)

Santa Monica, CA 90404

424-281-6811

Chapel Hill

50101 Governors Drive (Ste 280)

Chapel Hill, NC 27517

910-742-0509

N. Myrtle Beach

1000 2nd Ave S (Ste 300)

North Myrtle Beach, SC 29582

843-808-5236

Temecula

41877 Enterprise Cir N. (2nd Floor)

Temecula, CA 92590

424-281-6811

Privacy Policy | Powered by Levitate

Investment Advisory Services offered through Glasgow & Associates, LLC. Glasgow & Associates is a Registered Investment Adviser regulated by the North Carolina Secretary of State Securities Division. Additional information about Glasgow & Associates is available on the SEC’s website at www.adviserinfo.sec.gov.